Unlock the Strategies of the Financial Elite

Pay Off Your Home Quickly and Build Generational Wealth

For decades, the Financial Elite, those who understand how money truly works, have quietly applied specialized strategies to eliminate debt faster and grow enduring wealth.

At McBroom Financial, we believe those proven strategies shouldn’t be reserved for the select few. Now, you can access them, with a personalized plan designed for your unique goals.

You’ve worked hard to build your success. Let your money work just as hard for you.

Alan McBroom

Taylor L.

When I first connected with Alan in early 2022, I thought I was doing everything right. I had a low-interest mortgage, solid credit, and was making regular payments. But Alan opened my eyes to how much money I was still handing over to the bank.

He helped me create a plan that showed exactly how I could pay off my home in 6 years instead of 25, without changing my lifestyle or monthly budget. Just smarter use of my income. By the end of 2022, I’d already knocked years off my payoff timeline and saved thousands in interest. I only wish I’d met Alan sooner.

Stop Building the Bank’s Wealth

Start Building Yours

The banks won’t tell you this because it does not serve their interests. Traditional mortgages are built to benefit lenders. Every month you stay on their timeline, you hand over interest that could be building your future instead of theirs.

My wife Joan and I have seen this firsthand in so many cases. After years of helping others break free from this cycle, we founded McBroom Financial to share the same proven strategies the Financial Elite have used for generations.

The Financial Elite do not let their capital sit idle. They put their money to work, building wealth, security, and freedom for themselves and their families.

With the right plan, you can do the same.

Pay off your mortgage in as little as 5 years, without increasing your monthly budget

Save $100,000 or more in unnecessary interest

Reallocate cash flow toward tax-advantaged retirement and investment strategies

What Makes McBroom Financial Different?

McBroom Financial offers more than financial advice

We educate our clients and provide:

Access to proven wealth-building principles long used by the Financial Elite

We guide you through strategies that have helped the financially successful eliminate debt faster and put their capital to work. These are not theories or trends. They are time-tested principles that prioritize efficiency, growth, and security.

A clear, math-driven plan — no gimmicks, no risky investments, no lifestyle changes

Our system is built on solid numbers, not guesswork. You won’t be asked to consolidate debt or invest in anything speculative. Instead, we help you use your existing income in smarter ways that produce measurable results.

A confidential, automatable experience designed to fit your busy life.

Our system is built for efficiency. Once your personalized plan is in place, much of it can run automatically, helping you stay on track without constant oversight. You receive private, professional guidance and a streamlined approach that works quietly in the background, giving you more time to focus on what matters most.

Personalized coaching from Alan McBroom, focused on your unique financial picture and long-term goals

Every homeowner’s financial journey is different. Alan takes the time to understand your specific situation, priorities, and vision for the future.

He provides customized guidance that aligns with your goals, helping you apply proven strategies in a way that fits your life and builds lasting wealth.

What Makes McBroom Financial Different?

McBroom Financial offers more than financial advice

We educate our clients and provide:

Access to proven wealth-building principles long used by the Financial Elite

We guide you through strategies that have helped the financially successful eliminate debt faster and put their capital to work. These are not theories or trends. They are time-tested principles that prioritize efficiency, growth, and security.

A clear, math-driven plan — no gimmicks, no risky investments, no lifestyle changes

Our system is built on solid numbers, not guesswork. You won’t be asked to consolidate debt or invest in anything speculative. Instead, we help you use your existing income in smarter ways that produce measurable results.

A confidential, automatable experience designed to fit your busy life.

Our system is built for efficiency. Once your personalized plan is in place, much of it can run automatically, helping you stay on track without constant oversight. You receive private, professional guidance and a streamlined approach that works quietly in the background, giving you more time to focus on what matters most.

Personalized coaching from Alan McBroom, focused on your unique financial picture and long-term goals

Every homeowner’s financial journey is different. Alan takes the time to understand your specific situation, priorities, and vision for the future.

He provides customized guidance that aligns with your goals, helping you apply proven strategies in a way that fits your life and builds lasting wealth.

About McBroom Financial

Hi! We're Alan & Joan McBroom, the founders of McBroom Financial. Here's a quick background about us:

Alan McBroom discovered a passion for helping people during their most vulnerable moments during his three decades of ministry experience, including serving as a Pastor and Hospice Chaplain.

Now, he channels his profound insights into financial planning that starts with getting people out of debt in the shortest time possible. Together, Alan and each client construct personalized holistic financial plans, ensuring dedicated fiduciary guidance for a secure and prosperous future.

Joan excels in financial services, she has spent over 12 years in the industry driven by a selfless dedication to integrity and client well-being. Her primary duties on the McBroom team are team training, membership and management, as well as marketing.

Beyond work, she spends time with her 4 grown children and her 12 grandchildren, enjoys adventures with her husband, and relishes travel. With global living experiences and a diverse educational background, including Theology and Education, Joan eagerly looks forward to connecting with you to provide tailored support.

Why Act Now?

Every month you stay on a traditional mortgage schedule is a month your money could be working harder for you.

The Longer You Wait...

The more you pay in interest that benefits the bank, not your future

The longer your capital stays tied up instead of building wealth

The less time you have to create lasting financial security

Stop Wasting Time by Giving Your Hard Earned Money to the Banks!

Every month on the bank’s plan means more interest for them and less wealth for you. With the right strategy, you can take control, pay off your mortgage faster, and make your money work for your future.

HOW IT WORKS

We've made getting started simple.

Take our 30-second qualification quiz

a few easy questions to determine if our system aligns with your goals.

Book your private consultation

Meet with Alan 1-on-1 virtually at your convenience for personalized advice.

See your personalized plan

Discover your exact debt free date and potential savings using our customized calculators and see how any changes would play out.

Decide if you’re ready to start saving

At the end of the day, my job is to inform you about your options, it's always going to be your decision if the system is right for you.

Frequently Asked Questions

We believe that transparency is key to building trust

Is this a bi-weekly payment plan or debt consolidation?

No. This is a proven, math-driven system the Financial Elite have used for decades — not a gimmick or restructuring of your debt.

Do I have to increase my budget each month?

No. Our system works within your current monthly budget.

Is my personal information secure?

Yes. We don’t ask for sensitive details like social security numbers during the initial process. Our consultations are private and confidential.

What kind of client is this right for?

Our approach works best for homeowners who are serious about maximizing their financial potential, have stable income, and want their money working smarter.

How long will it take to see results?

You will immediately be able to see the Debt-Free date and most clients see 10s of thousands in cancelled interested payments within the first year or two.

Is this strategy only for people with large mortgages?

No. While larger balances often mean larger savings, our system can create significant benefits for a wide range of mortgage sizes.

Do I need to change my spending habits to make this work?

No. Our system works with your current lifestyle and budget. It is designed to help you use your existing income more efficiently.

What if I already have a low interest rate?

Even at a low rate, you could still be paying tens or hundreds of thousands in interest over time. Our system helps you eliminate that cost faster.

Now for the more frequently asked question...

What Does It Cost to Get Started?

At McBroom Financial, we believe in earning your trust before you invest. That’s why:

Your consultation and initial strategy session are completely free.

This no-obligation meeting gives you a chance to:

- Review your unique financial picture

- Discover your personalized debt-free timeline

- See how much interest you could save using our proven system

You’ll leave the session with clarity and a clear sense of what’s possible.

When You’re Ready to Move Forward

If you choose to continue, our full coaching program becomes available.

This is NOT a free mass-produced course or useless generic advice.

Our coaching includes:

- A customized plan built around YOUR goals, income, and debt

- Personal guidance from Alan McBroom at EVERY step

- A system designed to pay for itself many times over through interest savings and long-term wealth growth

The coaching program is a one-time investment, usually consisting of less than 2-3 of your mortgage interest payments and it is typically included as part of the total debt plan.

We are happy to provide full details during your initial consultation so you can make an informed decision with full transparency.

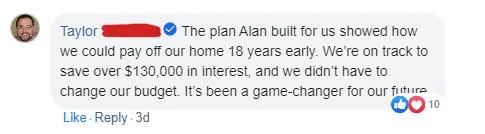

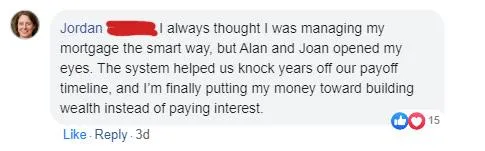

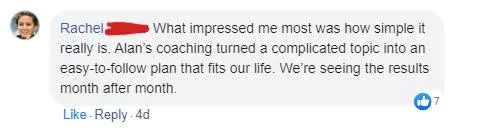

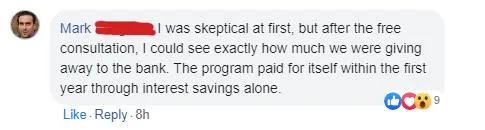

Why Our Clients Choose McBroom Financial

Our clients come to us looking for a smarter way to pay off debt and build lasting wealth. With the right plan, they stop overpaying interest and start making their money work harder. Here are just a few of the comments we have received.

Start applying the strategies of the 1% today

Take the quiz now to discover your debt-free date, your potential savings, and how to put your capital to work for your future.

It’s not magic. It’s proven strategy, and it’s ready to work for you with McBroom Financial.

McBroom Financial 2026 - Privacy Policy